The Minister of Economy and Investments, Mays Mouissi, explained, on November 18, 2024 in Libreville, the ins and outs of the early repurchase operation of the Eurobond 2025. This strategic approach aimed to lighten the burden of external debt while strengthening Gabon’s financial resilience. What you need to understand.

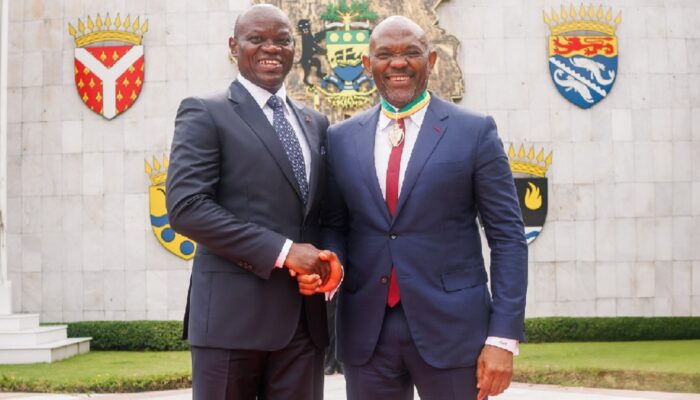

During a press briefing on November 18, 2024, the Minister of Economy and Investments, Mr. Mays Mouissi, explained the early repurchase operation of the Eurobond 2025 of the Gabonese Republic. Announced by the President of the Republic, Brice Clotaire Oligui Nguema, on October 21, this initiative resolutely marks a turning point in the proactive management of the country’s public debt. It demonstrates Gabon’s desire to consolidate its credibility on international financial markets.

Started on November 7 and closed on November 14, 2024, the operation exceeded initial expectations. “ The buyout objective was fully achieved, with the participation of more than 260 international investors, for an amount of 275 billion CFA francs, or more than 156%. The transaction was concluded at a price of 99.25 cents on the dollar ,” Mays Mouissi stressed. In fact, these figures reflect renewed investor confidence in the Gabonese economy.

With a total principal amount of 180 billion CFA francs out of an initial outstanding amount of 376 billion CFA francs, the operation made it possible to reduce by half the debt maturing on June 16, 2025. ” His Excellency the President of the Republic, President of the Transition, Head of State, Mr. Brice Clotaire Oligui Nguema, decided and announced on October 21, 2024, an early repurchase operation of half of the Eurobond 2025 of the Gabonese Republic on the international financial markets ,” recalled the Minister of Economy and Participations. The challenge was to anticipate financial pressures while restructuring the external debt to make it more sustainable.

A Eurobond is ” a bond that allows states or companies to borrow in a currency other than that of the issuing country ,” explained Mays Mouissi. In Gabon’s case, these are Gabonese Treasury bonds issued in dollars on the international financial market. As a reminder, the Eurobond 2025 was issued in June 2015, under the previous regime, for an amount of 500 million dollars, with a maturity of 10 years and an interest rate of 6.95%. Carried out under the Ali Bongo regime, this issue was officially intended to finance infrastructure projects and support the country’s economic development. Over the years, however, servicing this debt has become a significant burden on public finances, hence the transitional government’s decision to proceed with an early repurchase.

The success of this transaction, however, was not the result of chance. It is part of an elaborate strategy aimed at limiting Gabon’s dependence on foreign creditors. ” The buyout was financed by bond issues carried out on the sub-regional market through two domestic syndication operations, thus making it possible to convert part of the external debt into domestic debt ,” explained the Minister of Economy and Participations. This innovative approach reduces exposure to currency fluctuations and promotes the mobilization of resources on local markets.

Even though this conversion was made at a slightly higher rate – 7% compared to 6.95% for the repurchased debt – it nonetheless reflects strategic budgetary planning, as the minister stated: ” This transaction is part of the proactive strategy for managing the Republic’s public debt .” Mays Mouissi did not fail to point out that this decision strengthens budgetary flexibility while consolidating Gabon’s position on the financial markets.

The early redemption of Gabon’s Eurobond 2025 comes in an uncertain global context, marked by increased competition on international financial markets. At a time when interest rates are very high on international financial markets, the success of this operation, which will have a positive impact on Gabon’s credit history, is the result of exemplary collaboration between the Administration and local banks ,” said Mr. Mouissi. This success, according to many commentators, is a testament to Gabon’s ability to innovate and adapt to overcome financial challenges.

By sending a message of responsibility and rigor to its international partners, Gabon is positioning itself as a reliable and dynamic player on the African economic scene. An important milestone which, according to Mays Mouissi, paves the way for other structuring initiatives for the country.