Gabon is taking a decisive step in controlling its energy resources with the finalization of the acquisition of Assala Energy by the Gabon Oil Company (GOC), according to an announcement from the Carlyle group on June 21. The transaction, which ends months of negotiations and international rivalries, underlines the country’s commitment to strengthening its control over its oil assets.

The Carlyle group announced, this Friday, June 21, the finalization of the sale of its oil and gas subsidiary Assala Energy to the Gabon Oil Company (GOC), the national oil company of Gabon. This transaction marks the culmination of a process begun last February, when GOC exercised its right of pre-emption on the sale initially planned to the French company Maurel & Prom for $1.3 billion.

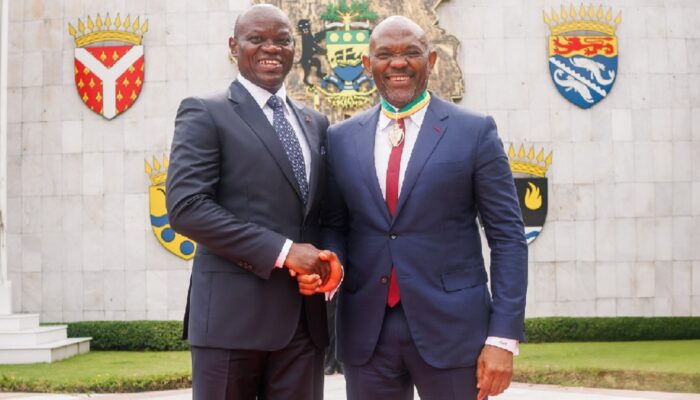

This acquisition is part of the Gabonese government’s strategy to strengthen its control over the country’s natural resources. The president of the transition, Brice Clotaire Oligui Nguema, reaffirmed this intention during his wishes of December 31, 2023 to the Gabonese.

Presumably, based on an amateur video showing the Gabonese actors at the heart of the operation, Gunvor, a company specializing in the trade, transport and storage of petroleum products and other products of the oil industry, is the major partner of the Gabon in this acquisition.

For the record, the transaction was the subject of intense behind-the-scenes negotiations, notably involving Swiss traders Gunvor and Vitol. According to sources close to the matter, Gunvor would have offered $950 million to GOC to facilitate the takeover, while Vitol, in exclusive negotiations with the national company, would have promised a significant sum in exchange for the commercialization of the oil production of Assala Energy, estimated at 45,000 barrels per day. Vitol’s proposal was probably not accepted by Gabon.

The assets concerned, resulting from the repurchase of Shell permits in 2017 for more than $700 million, represent a major strategic issue for Gabon. Although Carlyle did not disclose the financial details of the transaction with GOC, this acquisition should allow the Gabonese state to significantly strengthen its position in the national oil sector.

The finalization of this sale marks an important step in the restructuring of the Gabonese oil landscape and could have repercussions on the economic and geopolitical balances of the region. It now remains to be seen how GOC will manage these new assets and what impact this acquisition will have on the country’s oil production in the medium and long term.