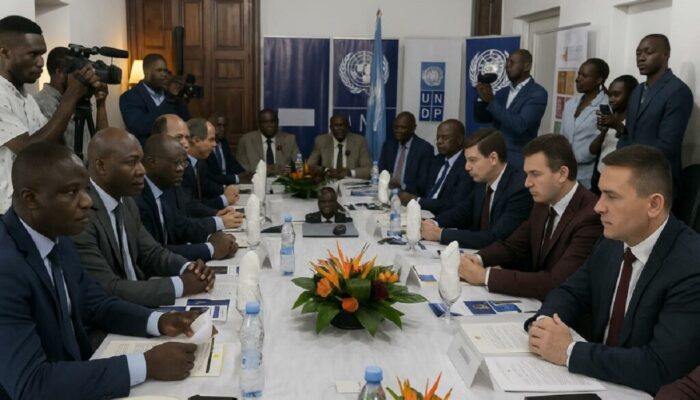

Under discussion at the expert level of the Minister of Mines, the project on the mine guarantee fund is intended to finance the development of a mining industry in the Republic of Congo and the constitution of a gold reserve.

The Congolese mining sector, more exactly the gold industry, is developing. Gold panning activities are still dominant in several localities, with environmental consequences in the departments of Kouilou, Niari, Cuvette-Ouest and Sangha.

During these years, the government has multiplied initiatives to try to regulate this sector and promote the preservation of the environment. Thanks to the support of the United Nations Environment Program, the Congo has adopted a National Action Plan for artisanal and small-scale gold mining. The authorities have also undertaken to implement a multi-year project through the program of global opportunities for the long-term development of the artisanal mining sector.

The data collection in the field which was launched recently will make it possible to define the intervention strategy, analyze the local context leading to the development of the detailed document for the said project and generate the support of stakeholders, namely: the artisanal miners; Public powers; parliamentarians; environmental protection organizations; academics; researchers and development partners.

According to Bernardin Ludovic, one of the UN experts accompanying the country in this reform, the solution also involves raising the awareness of craftsmen and formalizing the Congolese mining sector. “You have to show them the best environmentally friendly practices, or teach them other income-generating activities. The chosen approach must take into account the political, social, economic and environmental dimensions, in order to strengthen formalization efforts, “said this UN expert.

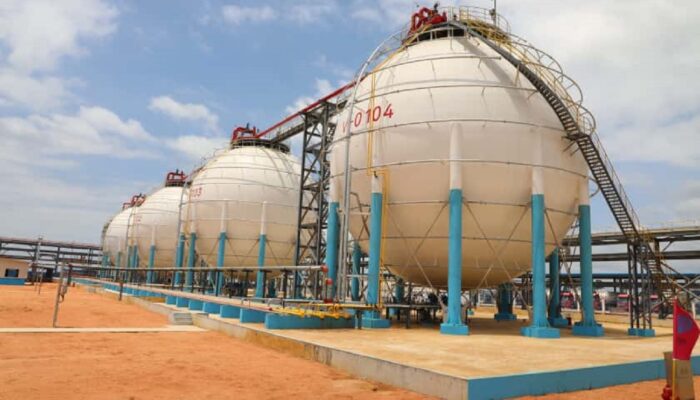

The other issue of the guarantee fund is economic, admits a source familiar with the matter. Because if the country succeeds in improving national production, it will be able to buy it back from industry to build up gold stocks. At this point, the authorities will be able to choose between trading on the international market and depositing the central bank, in order to reassure investors.

Recognized as a store of value, gold is also considered an effective diversification tool. The precious metal is a real economic security for central banks, an insurance for the future.