The United Bank for Africa, UBA, is in the process of recapitalization which gives investors across the globe and Cameroon in particular where it has a strong hold chance to reap big. The Bank is said to have already tabled its application for the recapitalization process at the Security and Exchange Commission, SEC. The approval is projected to be out not long from now.

According to officials of UBA, the Bank is also in the process of expanding its capital base to further strengthen its position across the globe in driving development especially in countries where it operates. In the coming weeks, UBA management is expected to make public specific details relating to how the recapitalization process will play out.

The Bank is optimistic and righty so that its clients and partners will take advantage of the recapitalization drive. It is a move that has left shareholders gleeful given the outstanding performance of UBA across financial benchmarks for the first half of 2024.

UBA’s audit report for the first half of this year show its earnings were powered through interest, commissions and fees unlike in 2023 wherein foreign exchange accounted for its gain. The resilience and dynamism of this bank on the stock exchange, has left investors and potential investors upbeat. The high dividends paid to shareholders by UBA is also another factor that sets it apart as the premium bank giving the highest value to its shareholders. The bank’s Profit Before Tax, PBT, in the first six months of this year was capped at Naira 402 billion (141,182,150,961.00 FCFA). Within the same period in 2023, PBF was at Naira 403 billion (141,533,350,341.50).

Given its continuous positive outlook and growth across all markets, the ongoing expansion of the capital base of UBA, is seen as a huge opening for investors. In Cameroon, experts are firm that, it is a golden opportunity for those looking for the best places to spend.

At a time when government is focused on making the National Development Strategy, SND 2020-2030, the Import-Substitution policy of the Head of State papable realities, UBA Cameroon as a citizen-friendly institution is a vital partner.

The Bank’s known stability with its continuous upward growth and high disbursements to shareholders, places the UBA as a financial institution, of distinct reliability and credibility.

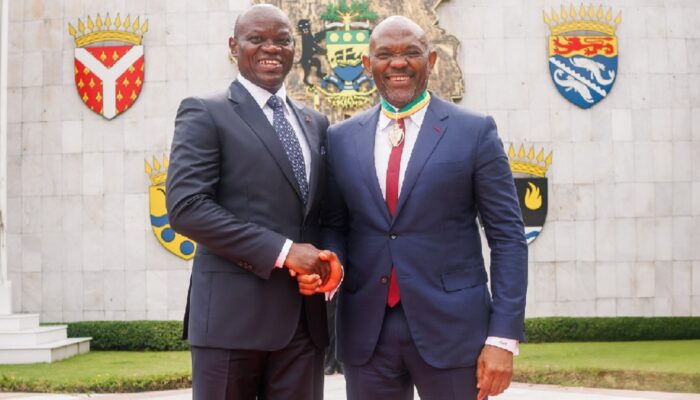

The Group Managing Director, GMD and Chief Executive Officer, CEO of UBA, Oliver Alawuba is said to have remarked during the Bank’s Investors Conference staged days ago that, it remains unshaken in giving value to investments.

“We have remained resilient and focused on executing our strategy, driven by our commitment to the principles of Enterprise, Excellence, and Execution,” Alawuba is quoted as having said during the meeting.

He was clear that: “A robust capital base also attracts foreign investments, as global investors seek stability and growth opportunities,” but situated: “UBA’s commitment to Environmental, Social, and Governance (ESG)” schemes.

The UBA Group Managing Director also noted that: “At UBA, we are determined to ‘do good’ by supporting inclusivity and environmental sustainability. We have pledged to plant one million trees over the next one year as part of our environmental stewardship”For the future, he mentioned sectors wherein UBA’s packages will be expanded to reach people across Africa. “We continue to roll out our Braille account opening packages to more countries, promoting inclusivity for visually impaired customers. Our loans to young entrepreneurs, women-led businesses, and SMEs across Africa are part of our broader commitment to driving inclusive growth,” Alawuba remarked.

In May this year, the Group Chairman of UBA, Tony Elumelu had evoked the Bank’s interest to give its customers across Africa to invest. “We, the board approved and today shareholders supported it that we do private placement and this private placement will give opportunity to our customers and friends across Africa to invest in United Bank for Africa. When all of these investments come in from the rights (issuance) and re-investments by these shareholders, it will be an easy accomplishment,” Elumelu had said.