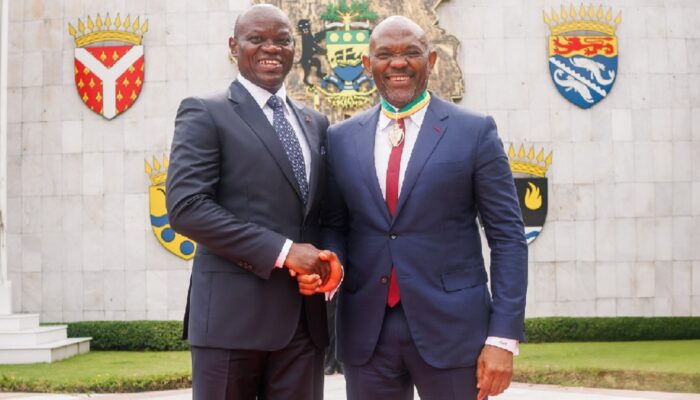

After the agreement between UBA Group and the Africa Continental Free Trade Area (AfCFTA) Secretariat in 2023 to invest $ 6 billion as funding for African Small and Medium Enterprises within the next three years. The MD/CEO of UBA Cameroon Jude Anele accompanied by some top executives held a round table session with the media in Douala at the bank’s Head Office.

The aim of this sit down with the media drawn from the audio-visual, print, and online was to reveal and explain how this will benefit SMEs in Cameroon, the conditions, and perspectives. It was also an opportunity to reveal the work being done with SMEs and the importance UBA attaches to this segment of the economy.

The very animated session gave all the 15 media organizations in attendance a chance to ask questions and share opinions on various aspects of this partnership with AfCFTA.

A breakdown of the $6bn investment shows that a total of $1.2bn has been budgeted for the year 2023, $1.9bn for 2024 and $2.88bn for 2025.

By this agreement, UBA to boost intra-Africa trade, will provide financial services in four main areas which are agro-processing, automotive, pharmaceuticals, and transport and logistics, to small and medium enterprises (SMEs) in all the 20 African countries where UBA operates

One of the key initiatives of the AfCFTA Agreement focuses on improving access to finance and markets for SMEs to encourage their growth and contribution to the socio-economic development of Africa

The objective is to catalyze Africa’s industrialization and boost intra-Africa trade to improve the socio-economic well-being of the continent and its people,

The four identified areas of support that UBA will provide will enable SMEs to achieve industrial-driven growth and export development in Africa.

SELECTED SECTORS

- agro-processing,

- automotive,

- Pharmaceuticals,

- Transport and logistics,

United Bank for Africa is one of the largest financial services providers on the African continent, with operations in 20 Africa. The bank is also present in the United Kingdom, the United States of America, France, and the United Arab Emirates. UBA provides Retail, SME, Commercial, and Institutional/Wholesale banking services and leads financial inclusion through cutting-edge technology and customer experience.