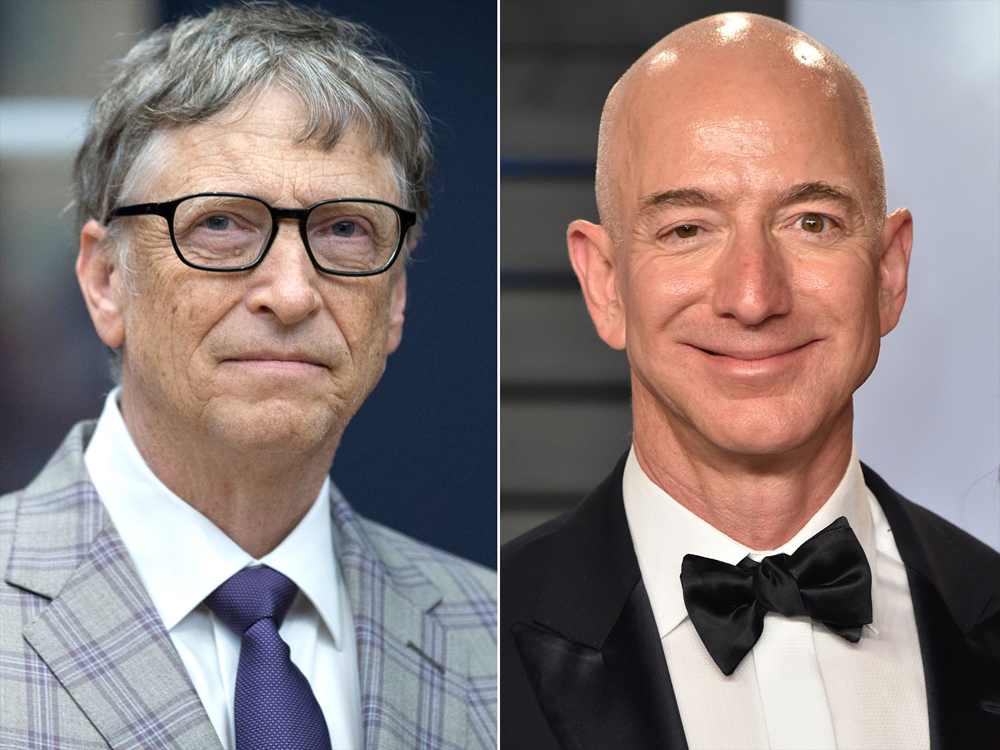

Backed by tech billionaires Bill Gates and Jeff Bezos, KoBold Metals is accelerating its footprint in the Democratic Republic of Congo. With seven new lithium exploration permits granted in August 2025, the company is positioning the Manono deposit at the heart of the global battery race.

The global rush for critical minerals is pushing Africa—and particularly the Democratic Republic of Congo (DRC)—to the center of energy transition strategies. On August 27, 2025, KoBold Metals, the U.S.-based company partly financed by the Breakthrough Energy Ventures fund supported by Bill Gates, Jeff Bezos, and other high-profile investors, announced the acquisition of seven new lithium exploration permits.

Manono: One of the World’s Largest Untapped Lithium Deposits

Located in the Tanganyika province, the Manono lithium project is considered one of the largest undeveloped lithium reserves globally, with resources estimated at 400 million tons of ore containing lithium oxide. KoBold Metals’ entry significantly strengthens investor confidence in the site, previously developed by Australian partners but facing delays due to financial and regulatory challenges.

With global demand for lithium expected to rise by more than 400% by 2035—driven by electric vehicles, renewable storage, and grid-scale batteries—the Manono project has the potential to turn the DRC into a strategic supplier in the green economy.

Billions in the Making

Analysts estimate that developing the Manono project could require over $3 billion in investments. For the DRC, this represents not only a financial windfall but also an opportunity to capture greater value through local processing and job creation. The government has repeatedly emphasized the need to move beyond raw material exports and establish domestic battery manufacturing value chains.

KoBold Metals, known for applying artificial intelligence to mineral exploration, has already raised more than $400 million globally and is targeting Africa as a long-term growth frontier.

Challenges Ahead

Despite this breakthrough, several challenges remain:

- Regulatory stability: past disputes over licenses and taxation could hinder investor confidence.

- Infrastructure gaps: Manono’s remote location requires massive investment in transport, power, and logistics.

- Geopolitical risk: instability in eastern DRC and wider governance issues could slow development.

A Strategic Move in the Global Battery War

KoBold’s accelerated push reflects the intensifying strategic race between Western investors and Chinese companies, the latter already dominating cobalt and copper in the DRC. Securing lithium supply is seen as critical for diversifying sources and reducing dependence on Asia.

For the DRC, the seven exploration permits granted to KoBold Metals send a powerful signal: the country is no longer just the world’s largest cobalt supplier but could soon emerge as a global lithium powerhouse, shaping the future of clean energy.