The Central African Financial Market Supervisory Commission (COSUMAF), the Financial Market Regulatory Authority of the Central African Economic and Monetary Community (CEMAC), is organizing, in collaboration with the World Bank (WB), a conference and exclusive workshops devoted to the regulation of the financial market and the development of the economies of the sub-region. The work, which began on November 5 and is due to end on the 8th of this month, has as its sub-theme the modernization of the regulatory framework of this financial market.

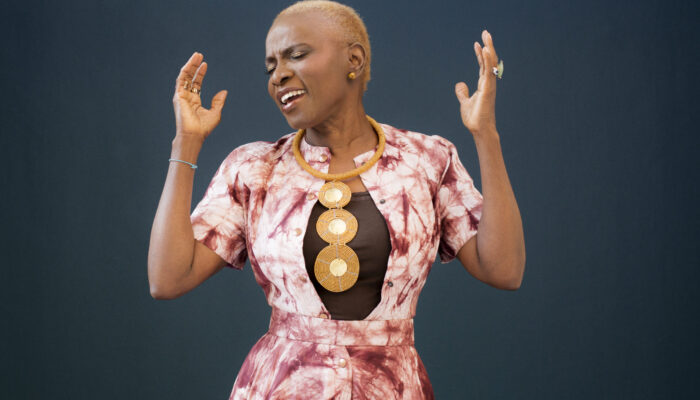

With a general mission to protect savings placed in securities and other financial instruments that are the subject of a public appeal for savings in all member states of the Central African Monetary Union, the Central African Financial Market Supervisory Commission (Cosumaf), headed by Jacqueline Adiaba-Nkembé, is organizing a conference and workshops in the Gabonese capital from November 5 to 8, which are intended to be ” unmissable “. The event brings together experts and professionals from the sector to discuss the latest developments and best practices in financial regulation.

In Libreville, around the president of Cosumaf, Jacqueline Adiaba-Nkembé, several former leaders of the Commission, as well as of the Financial Markets Commission of Cameroon (CMF) lent their expertise to this meeting, especially since ” their legacy ” continues to inspire and guide the actions of current leaders in the quest for a more dynamic and inclusive market. The ambition of this meeting was therefore to set the course for the future of the community financial market, as well as the continuous improvement of all stakeholders.

Speaking at the launch of the exchanges, the head of this CEMAC financial market watchdog stressed that ” in recent years, the global financial landscape has undergone radical transformations .”

Jacqueline Adiaba-Nkembé also points out that ” digitalization, the rise of fintechs (a fusion of the words “finance” and “technology” (financial technology), and refers to all new financial technologies used to improve financial services, Editor’s note), as well as growing expectations in terms of transparency and investor protection, require our region to review and adjust our regulatory framework .” This is to the extent that ” CEMAC must adapt to remain competitive and attractive, both for local investors and for foreign capital .”

For her, the envisaged modernization of the regulatory framework has several key objectives, namely ” strengthening investor confidence, improving investor protection, facilitating market access and encouraging innovation and digitalization .”

The main objective of the Libreville event is to present the progress made by Cosumaf in the context of modernizing the regulatory framework of the CEMAC financial market and to finalize the remaining instructions to complete this framework.

More specifically, Cosumaf sources specify, the work will involve presenting the new features of the regulatory framework; comparing the new framework with those of other countries or jurisdictions; finalizing the instructions still to be approved; and identifying the obstacles, beyond the regulatory framework, which hinder the development of the CEMAC financial market.