Though expecting 50 billion FCFA, the State of Cameroon is satisfied with 34 billion FCFA, obtained on the money market on April 29, 2020. It was during its third operation of issuance of Assimilable Treasury Bonds (OTA) that it engaged for some months, to obtain 220 billion FCFA in order to be able to finance its budget.

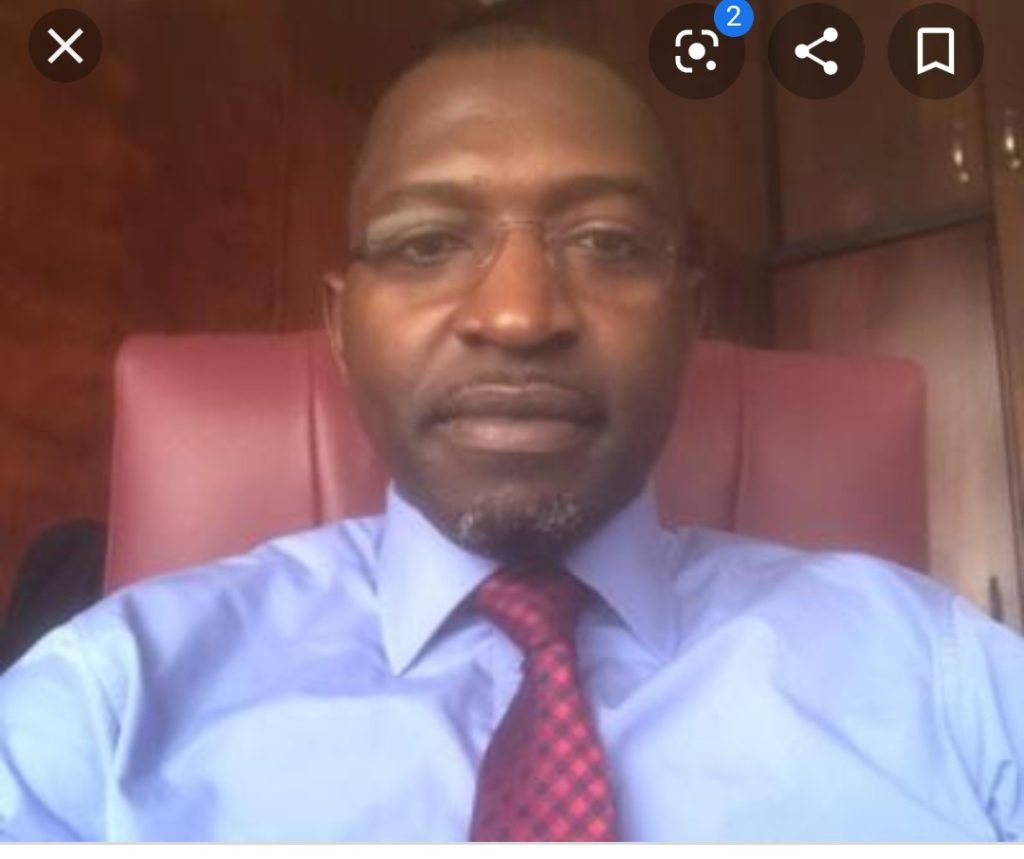

The Director of Treasury at the General directorate of the Treasury and of financial and monetary cooperation, Samuel Tela, specifies that Cameroon has “registered subscriptions for 46 billion FCFA but, ultimately retained only 34 billion FCFA because the prices to which the banks subscribed did not give us full satisfaction.

Samuel Tela justifies that “the objective is not to raise money at any cost. What we were able to mobilize on Wednesday (April 29, 2020) is a performance to be congratulated. If we had taken the 46 billion FCFA of subscriptions, it would have cost us a little more especially especially in a context of uncertainty for everyone because of COVID-19.”

Cameroon was not the only country in the Central Africa sub region that was attacking the financial market; Gabon and Congo have done the same.

Cameroon, which is used to going to the market at the end of the year, began at the start of the year to have more “room for maneuver to reach the objective of 220 billion FCFA. “

After the three issuances of the first quarter, the country already totals 140 billion FCFA. According to the Ministry of Finance, the country will return to the financial market on May 6, 2020.